Contents

Today we will get acquainted with Euronis, a scalper that does not use averaging but has some smart money management techniques. A popular technique used by the Euronis high-frequency trading algorithm is “trading from price channel boundaries”.

When to use Euronis

The use of price levels in trading is one of the most popular trading tactics, not only in the foreign exchange market. A price level is a certain price of a financial asset, which for one reason or another is considered important to the market or to a particular trader. With this level in mind, the trader attempts to enter the market.

Price levels can be calculated using an algorithm, formula, or historical data. They can also be used in trading in different ways, either on a breakout or a rebound.

The idea behind Euronis is that it only trades on rebound levels, and only during quiet times, for example during the Pacific session, when market fluctuations are minimal. During the night, it is less likely that the price will fluctuate. This allows the price corridor boundaries to be defined more accurately and trades to be closed with profits more often.

The Euronis advisor can also be used at any other time, although the developer does not recommend it.

What are the technical features of the Euronis advisor?

The initial deposit size can be chosen according to your trading style, so all other parameters should be adjusted according to your trading balance.

Leverage should be set as high as possible, usually from 1:100 and above. Such leverage will be required in case of a drawdown when Euronis will need all the funds to be able to trade further.

Both major currency pairs and cross rates are suitable for trading. The former are EUR/USD, GBP/USD, USD/CHF and USD/CAD, the latter are EUR/CHF, EUR/GBP, CAD/CHF, EUR/CAD, GBP/CAD and GBP/CHF. It is recommended to trade on the M15 timeframe.

Euronis has a very interesting feature that allows you to trade cross rates through the US dollar. For example, you set Euronis on the EUR/CHF pair and activate the “trade via USD” function. In this case, Euronis will open corresponding positions on pairs that have USD in them, namely EUR/USD and USD/CHF. This method saves a lot on the spread, which is very important for scalping.

What are the settings for Euronis?

- Lots – use a fixed lot when trading. If 0, the lot is calculated automatically

- LotsPercent – the percentage of the deposit that is used as the risk in the trade and the calculation of the trading lot

- BalanceControlMode – Balance control mode only works if Lots = 0.0

- 0 – normal mode where the lot is calculated as a percentage of the deposit

- 1 – holding the maximum lot in case of a drawdown

- 2 – recovery of the deposit after a drawdown

- 3 – recovery from drawdown and compensation for lost profits

- 4 – Combining modes 1, 2, and 3

- ResetMaxBalance – resets the value of the maximum balance. The setting is necessary to obtain correct information about the maximum balance

- SettingsNumber – number of programme settings, from 1 to 10

- CheckDrawDown is a function for switching from normal mode to minimum drawdown mode

- LowRiskSettingsNumber – number of programme settings, for minimum drawdown mode, from 1 to 10

- StopLoss – the maximum amount of loss on each trade, stated in points

- TakeProfit – the maximum profit for each trade, stated in points

- InvisibleStopLoss – activates the ‘invisible’ Stop Loss

- TrailingTakeProfit – Trailing Take Profit

- MinOrderLifeTime – limits the minimum duration of an open order

- UseAutoTimeSettings – Automatic time zone detection

- TimeZone – deviation of the terminal time from the GMT

- SWChangeMode – The terminal’s summer and winter time changeover mode

- 0 – change to Europe

- 1 – change to the US

- 2 – there is no changeover to winter time

- TimeRiskFactor – time risk limit, from 1 to 10

- ShowTimes – displays information about the Expert Advisor’s trading time

- ShowInformation – output of Euronis advisor’s comments

- InformationStringNumber – number of visible Euronis comments

- SaveInformation – saves the comments to a file

- UseMailReport – sends a report to an email

- MailReportHourGMT – GMT report sending time

How to test and optimise Euronis

Fully testing and optimising all the copies of Euronis would have been time-consuming, so we settled on the oldest version available to us.

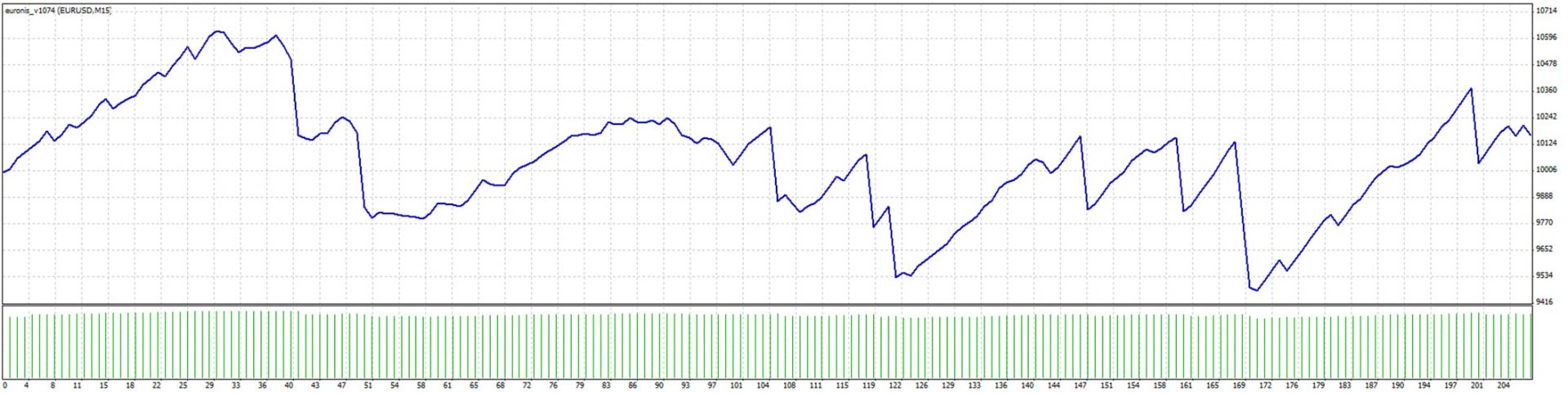

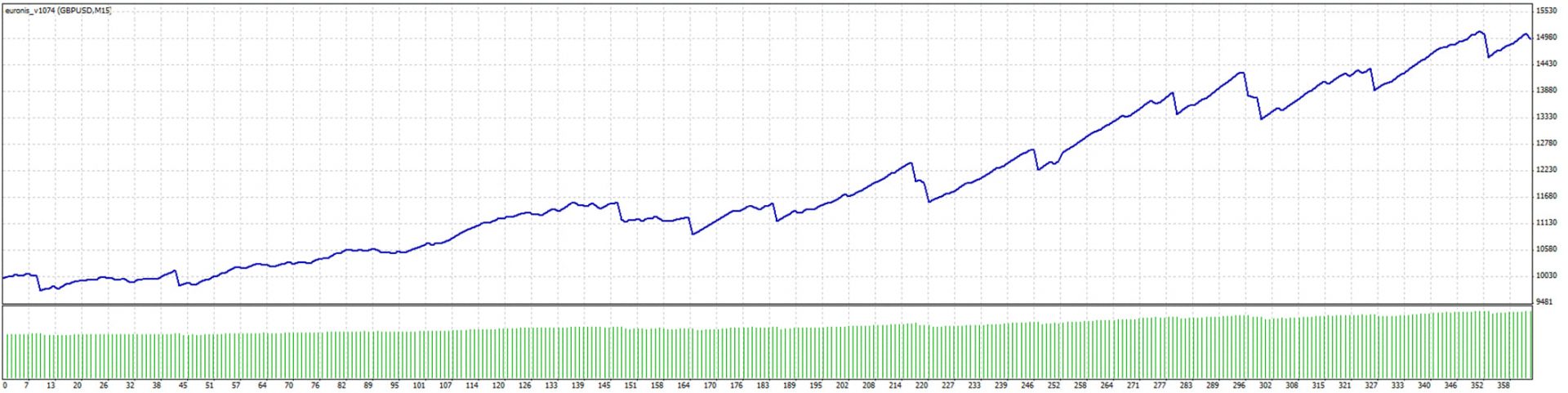

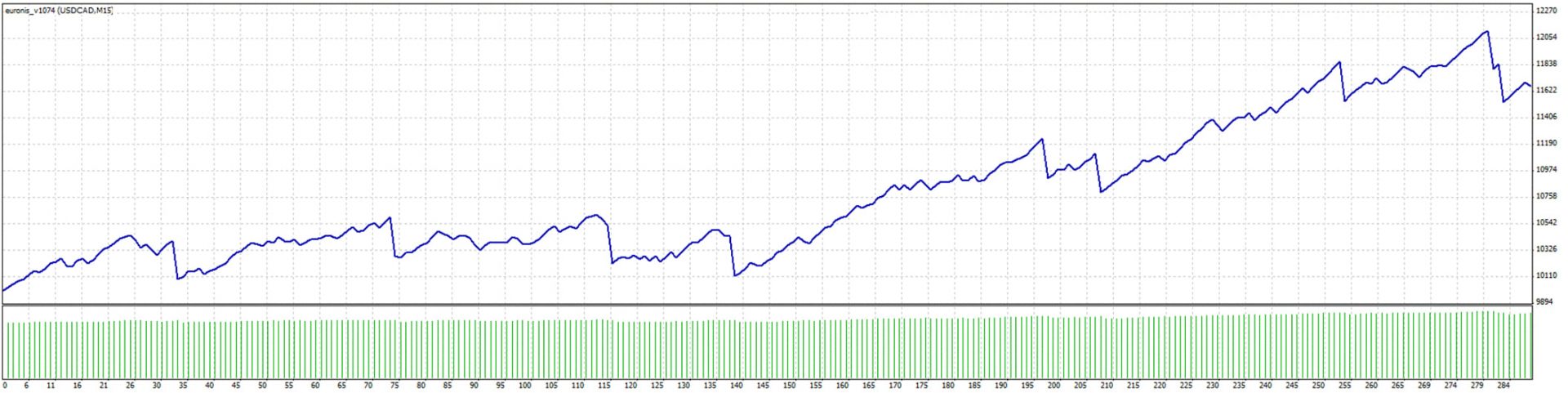

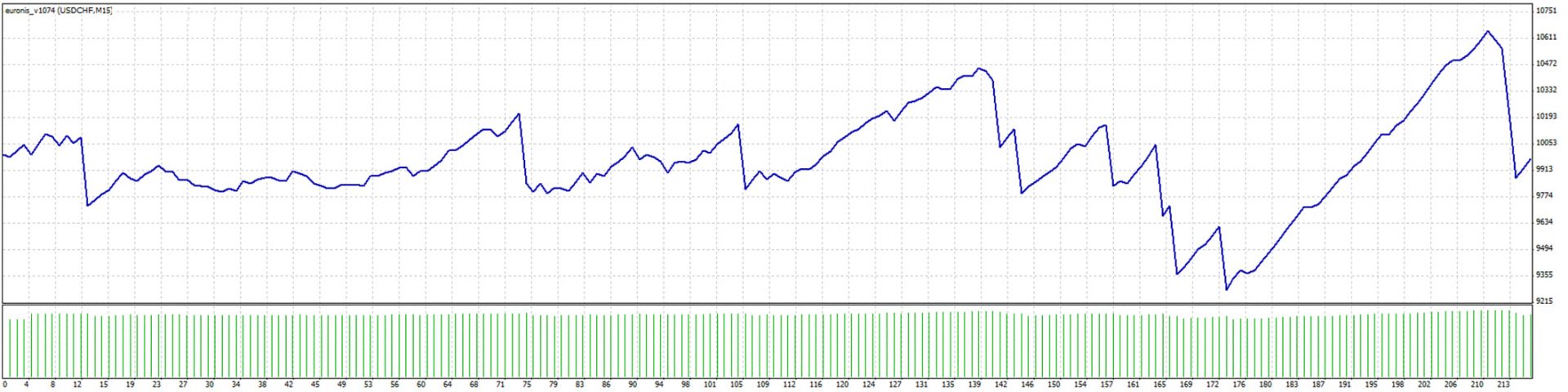

Euronis has enough recommended instruments to trade, so to save time we tested only the major currency pairs.

We can see that the pound was tested with the best result, although the euro is considered the most popular trading instrument. Therefore, we performed optimisation on the same section of the chart, but we only touched those parameters, which are responsible for the trading algorithm – SettingsNumber, LowRiskSettingsNumber, and TimeRiskFactor.

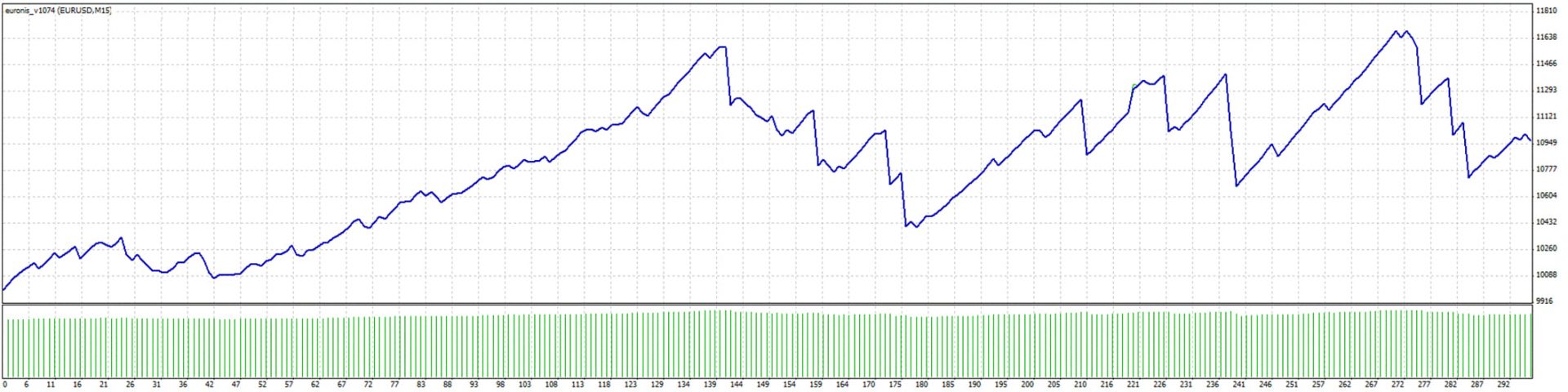

The best result was observed with SettingsNumber = 5:

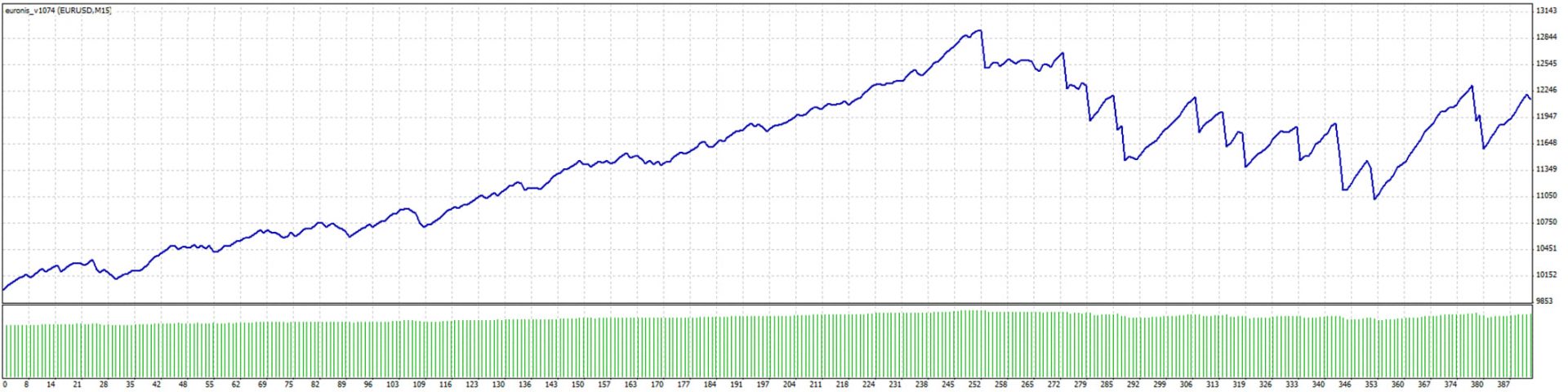

The best result was observed with LowRiskSettingsNumber = 6 and TimeRiskFactor = 8:

In addition, it has been noticed that trades rarely close at Stop Loss or Take Profit, so we have optimised these parameters as well.

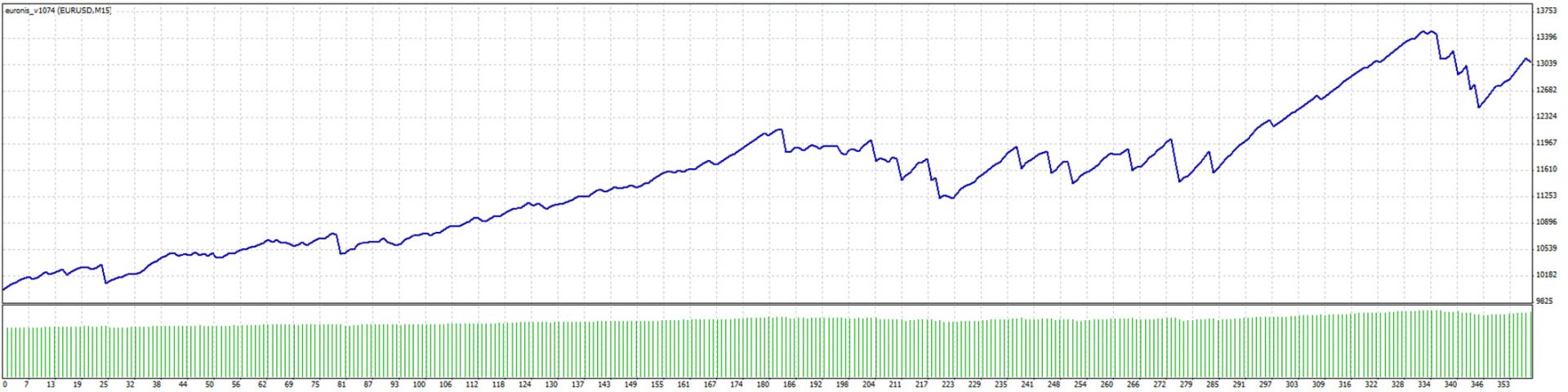

StopLoss = 24 and TakeProfit = 9:

Conclusion

Today, we discussed what Euronis EA is, when it is used, what its specifications and settings are, and how it can be tested and optimised for different parameters.

Euronis is based on a popular and logical trading strategy – “trading from price channel boundaries”. Even an inexperienced trader will realise that this strategy can be very effective when approached correctly.